Health Insurance

Provides coverage for medical expenses (both inpatient and outpatient), including hospitalization, doctor visits, medications, and surgical procedures.

Motor Comprehensive Insurance

Offers financial protection in case of accidents or damage to your vehicle. It can cover repairs, medical expenses, and liability for injuries or property damage caused to others.

Motor Third-Party Insurance

Offers financial protection in case of accidents. It can cover repairs, medical expenses, and liability for injuries or property damage caused to others.

Motor PSV Insurance

Offers financial protection in case of accidents and can cover repairs, medical expenses, and liability for injuries or property damage caused to others.

Personal Accident Insurance

Offers compensation for death, permanent disablement, temporary loss of income due to disablement and medical expenses arising from an accident.

Domestic Package Insurance

Protects your home or rented property against risks such as fire, theft, vandalism, and certain natural disasters. It can also cover personal belongings and provide liability coverage.

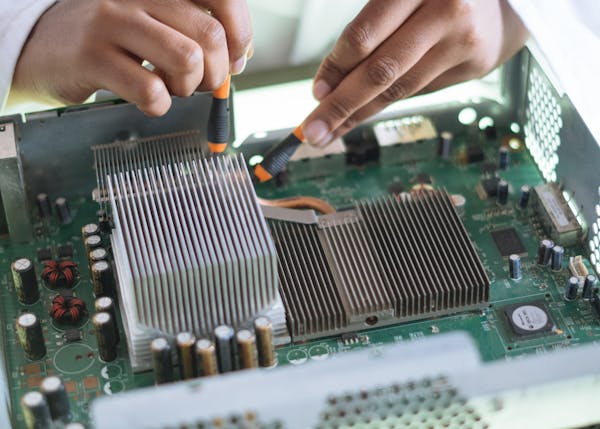

Electronic Equipment Cover

The policy protects the insured equipment against any unforeseen and sudden physical loss or damage. It is suitable for electronic items usually found in an office environment or in hospitals like; computers, medical equipment (X-rays, radiology, weighing scales etc.)

Burglary Insurance

Provides indemnity against loss or damage to property by theft following forcible or violent entry to or exit from the insured’s premises. Examples of properties insurable are: – office equipment, stock in trade and store, furniture, fixtures, fittings etc.

Life Insurance (Education Policy)

Pays out a sum of money to beneficiaries upon the insured person’s death. It can provide financial support which can be used to pay tuition fees.

Travel Insurance

Offers coverage for unforeseen events during travel, such as trip cancellation, medical emergencies, lost luggage, and travel delays.

Contractor’s All Risk Insurance

Suitable for contractors and covers; Contract works including materials, Temporary building and/or site improvements, Contractor’s plant, tools and equipment, Cost of debris removal, and Professional fees.

Business Insurance

Protects businesses from financial losses due to property damage, liability claims, business interruption, or other risks specific to their industry.

Office Combined Insurance

It offers protection against claims for accident and injury, property damage and business interruption, all within a single policy. It allows you to combine all of your office insurance needs into one simple package.

Professional Indemnity Insurance

Protects professionals (doctors, lawyers, consultants, etc.) against claims arising from errors or alleged negligence in their professional services.

Fire Insurance

Offers protection against loss or damage to property described, caused by fire and lightning but can be extended to cover allied perils like riots, strikes, malicious damage, storms, earthquakes, impact by vehicles, aircraft & other aerial devices, floods among other disasters.